In this primer, I will focus on the principal drivers of interest rates and discuss the impact of central bank purchases I believe that without the incredible bond-buying done by the Fed interest rates would be much lower, NOT higher I know this is counter-intuitive but if you look at Japan and Europe where bond-buying has been less than in the US, interest rates are lower because economic performance has been worse. In Japan, the major secular pressure started sooner and in Europe, it has been bad lately.

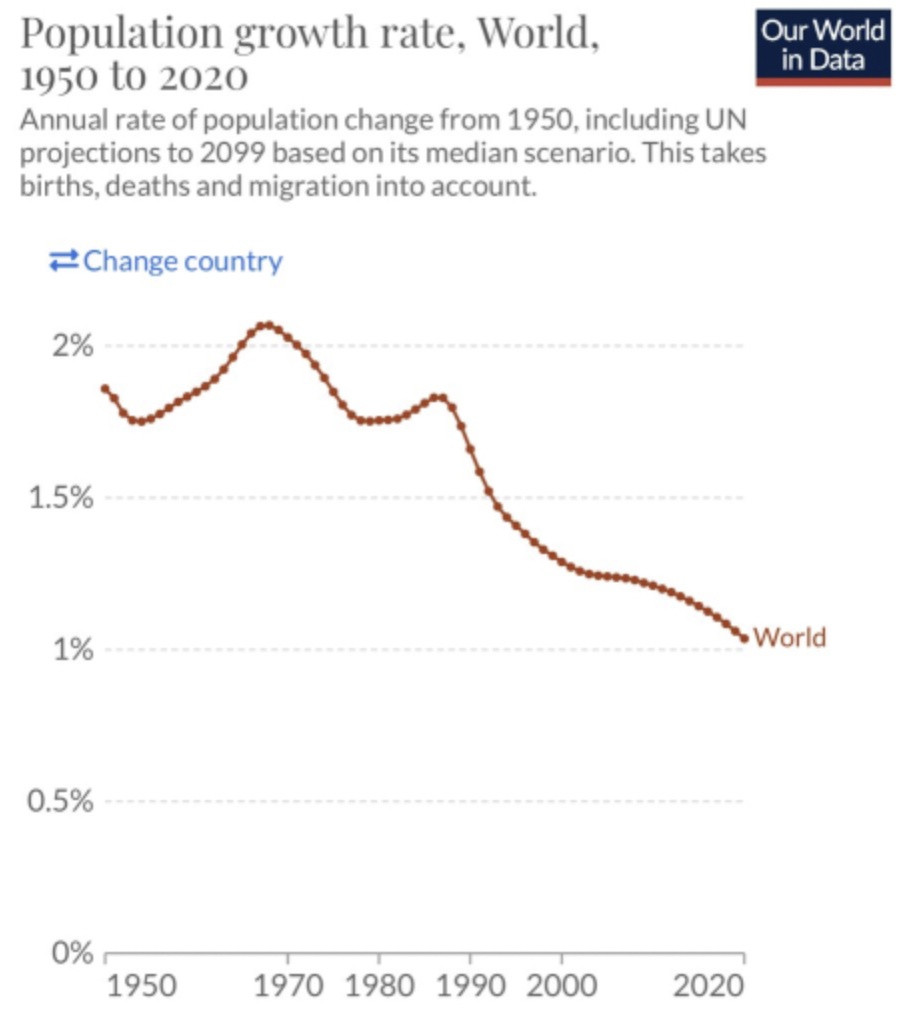

So what drives interest rates. Growth, inflation, and risk premium. If you have read risk premium 101 you know that Fed purchases do lower risk premiums. That has kept the pressure on rates for sure. BUT it’s not the big story. Long-term trend growth depends on two major forces. 1. Population growth and 2. Productivity. Essentially people work to consume.

The more people and the better they are at work the more GDP Population growth is in a permanent downtrend

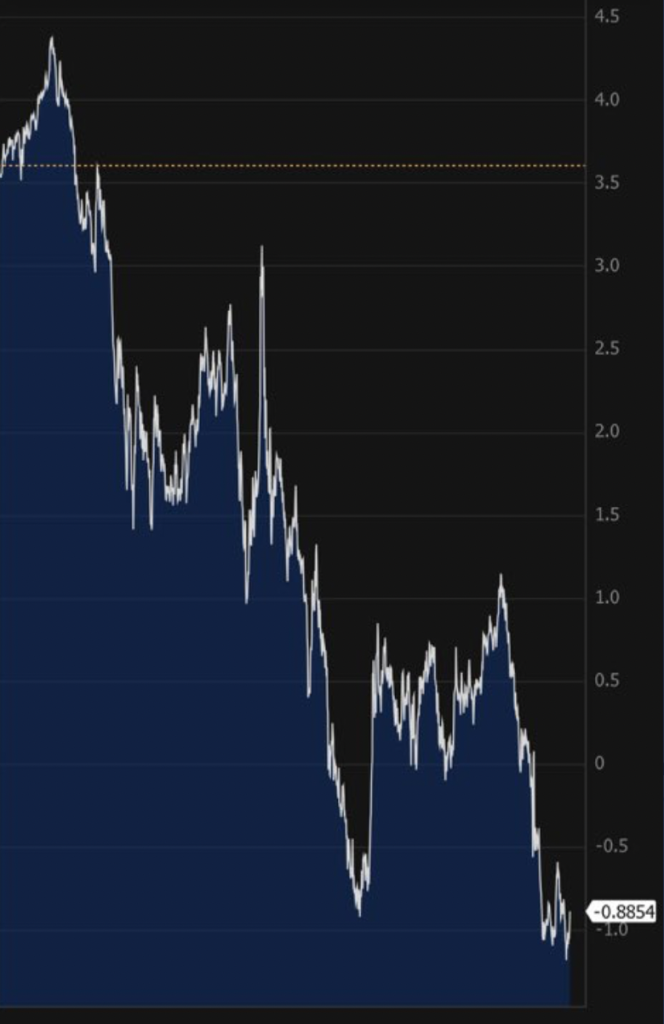

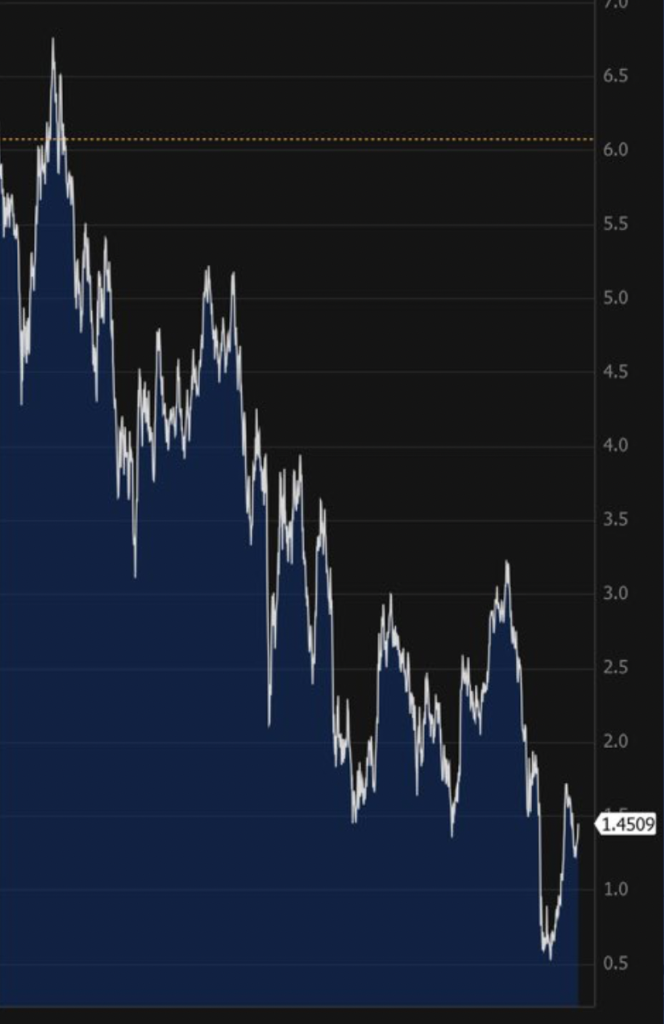

And while certainly there is room for emerging market citizens to “work better” productivity has been basically stable for decades

Nominal interest rates are also low because inflation has had a secular decline. I posted an article on http://dampedspringadvisors.com of my view about inflation back in March when there was a full-blown inflation panic. Called “Inflation and why it’s likely transitory” Inflation has popped this year but the secular pressure remains

So nominal rates are also very low and likely to stay low

The Fed has certainly bought a bunch of bonds and risk premiums have been squeezed. But that is a small thing. What matters is the secular pressures. Without the Fed purchases, the risk premium portion of yield would be higher. But the economy would have been drastically worse Growth would be well below trend, employment would be worse, and inflation would be zero or negative. That adds up to much lower rates. You can disagree on whether the Fed “Should” buy bonds. But it’s hard to disagree about the impact on rates and the economy.