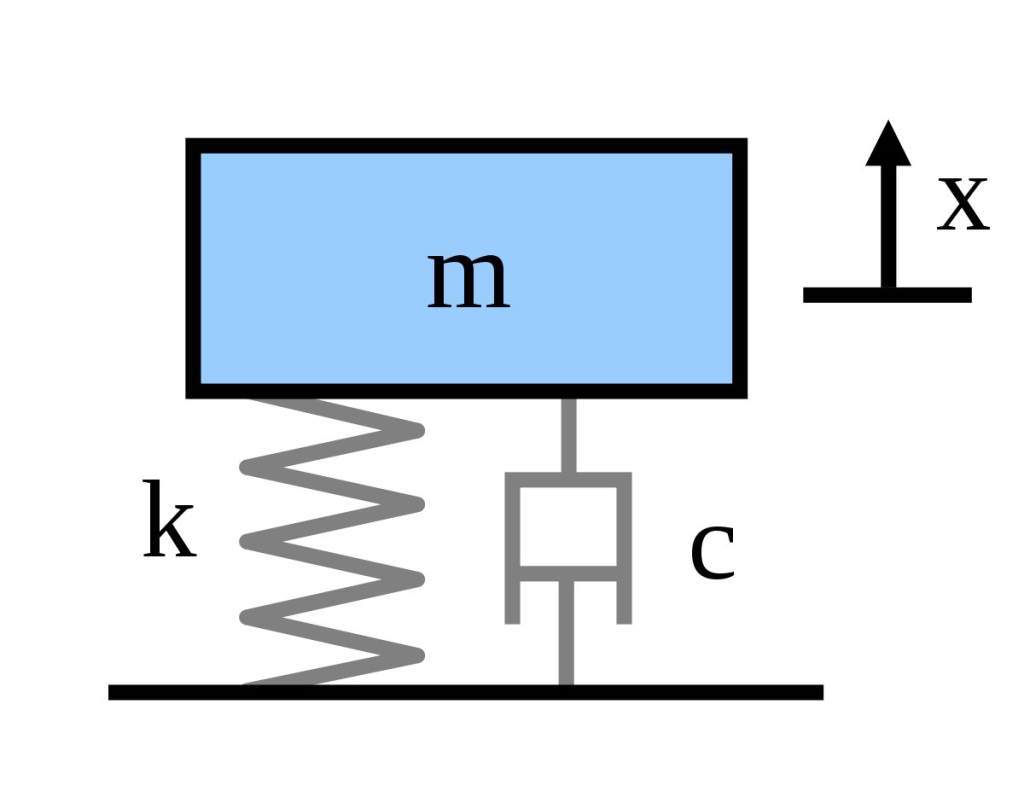

This thread is about the concepts I use to model future volatility based on the idea that news moves markets to new equilibriums and conditions of participants and external stabilizing agents dictate the path that markets take on the way. This is a conceptual model using a physical model of a force x impact a mass f and its energy being absorbed by a spring k and the spring action being dampened by a shock absorber c. Your car has this physical system to stay on the road over bumps.

I will tell you what each variable is and then go into each later

M is the market being modeled

X is the news

K is the condition of the market participants

C is the condition of various market stabilizing agents

M is the market.

Data that may matter includes. Absolute size Type of asset Characteristics of the asset such as inherent leverage or other asymmetry Breadth and depth of interested investors Other idiosyncrasies.

X is the news Essentially this shifts the equilibrium price.

News is shorthand for an impact. What is important is the news is not fully discounted. Even a coin flip can be properly discounted ahead of the flip but the result will impact the payoff.

News can be in the form of actual news or simply something that would result in a change in future expectations. It could simply be an unknown but impactful market participant changing her view and sending an order.

K is the conditions of market participants.

which might include financial leverage, whether investors are in draw down and by how much, composition by investor type and geography, Investment strategies, including passive/active and the end saver conditions

C is the shock absorber and it includes those who provide short or long-term liquidity to markets including banks, central banks, market makers, and fiscal policymakers.

Shock absorbers also include market mechanisms like circuit breakers and limited hours of trading. Essentially by measuring each of these input conditions one can get a sense of how volatile the path to equilibrium will be and how often and to what degree the equilibrium will be changed.

Further by observing the actual outcomes of markets in action data science can be used to understand the underlying variables based on the signal that occurs. Imagine watching a car bounce uncontrollably down a road. One could say wow that car needs some new shocks.

Some examples. The BoE was a massive damper ahead of Soros. No matter what the X the market wouldn’t move.

Margin calls. Markets can wildly overshoot their market equilibrium price if K (market participants) are close to margin call forced selling or short covering eventually market equilibrium settles.

When an M (market) has asymmetric payoff patterns the volatility can be skewed

This model is only conceptual. Lots of other physical devices may be useful to tune the system. In fact, I’m pretty sure electronic components would do a better job. But I find the physical system intuitive and easy to explain to myself and others.

I actually use this model to trade markets. To do so the measurement and weighting of the various factors that impact the model variable is quite challenging. It’s a crude tool that I constantly refine and improve.

One Response

The very next time I read a blog, Hopefully it wont disappoint me as much as this one. After all, I know it was my choice to read through, nonetheless I really believed you would have something helpful to talk about. All I hear is a bunch of crying about something that you could possibly fix if you werent too busy searching for attention.